Coaching to create meaningful change for your organization.

My name is Chris Clearfield. I’m an expert in complexity and an award-winning author.

I coach leaders & teams to use curiosity as their guide so that they can tackle complex problems with ease.

Does that sound like you?

Hard to get started. Hard to enroll others in your vision. Hard to get people to accept and embrace. It’s also hard to achieve different outcomes when you keep using the same mindset, and it’s hard to accomplish more while having the same resources.

Overwhelmed with more work, more complexity, and more confusion around change?

Breathe. There’s way through all this.

Ready to convert resistance from foe to friend?

and less about project management. We’ll discover what’s important to you and your teams to create the change your organization needs—to be and do better.

Know how to get started when feeling daunted and overwhelmed.

Uncover your path to create the change needed.

Connect with people where they’re at vs. where you think they should be.

Learn how resistance can create great insights about problems.

Lead change successfully using curiosity as your guide.

Solve complex problems by creating teams that work & jell together.

Ready to create a culture unafraid to take meaningful risks?

Have a guide by your side to move forward when things feel heavy and uncertain.

Meet to learn more • Uncover your barriers • Determine if we’re a match.

Learn how to learn • Build trust with your teams • Bring

others along (including your boss!).

Know how to get started • Experiment & improve • Be

ready for whatever’s next.

to the 2008 financial crisis and collapse. As it unfolded, I realized this was beyond the understanding of any one person. I wondered, “how could leaders manage such complexity?”

So, I left Wall Street to help people think about complexity in new ways.

Chris Clearfield

Founder

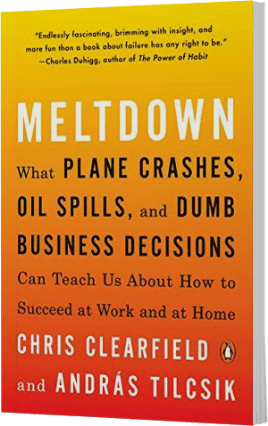

And, I wrote the book Meltdown, about how complex systems fail dramatically.

Now, I work with leaders willing to admit they don’t have the answers for the changes they sense are needed. Leaders who recognize that meaningful change is beyond the grasp of a single person. Those curious about what others see, think and feel. Those who know we only create meaningful change with others. Which is what we need to operate with more clarity and certainty in an age of complexity and doubt.

Are you willing to take risks?

Willing to recognize if the path were easy, you’d already know the answer?

Helping leaders understand how their being influences their doing.

A QUICK, SIMPLE, SCANNABLE GUIDE

(And how to avoid them!).

We’ll work together to create worthwhile and lasting change. Here’s what to expect:

Ready to create a workplace where people feel more connected?

“I know we need change, but I’m tired of feeling stuck. I feel daunted with the scope of the change needed, and frustrated watching people be less than their best. I want us to learn how to be comfortable even when uncomfortable, so we can create change that makes us feel proud, connected…and profitable.”

Well that sounds real. Let’s do that.

Clearfield Group

About | Process | Blog | Schedule Call

Clearfield Group

About | Process

Blog | Schedule Call

Too many leaders struggle to create change for their organizations—even when they have a strong vision. I offer coaching and group consulting workshops so that leaders can work with me to learn, practice and apply new ways to make an impact and influence their teams and stakeholders.